Advertisment

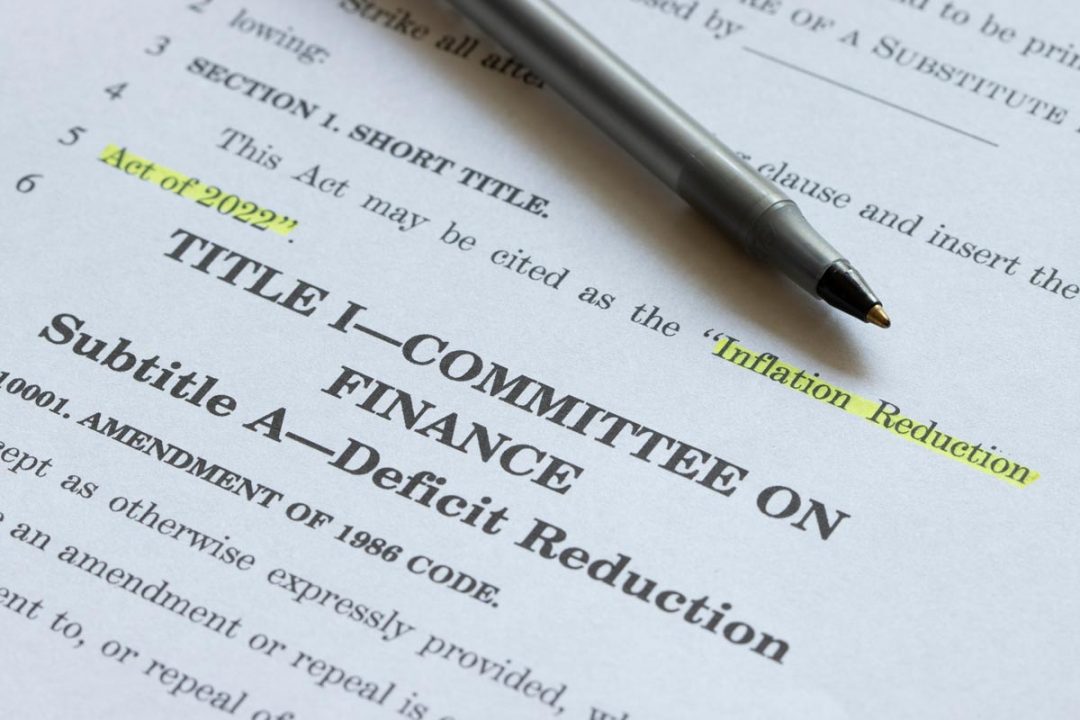

Biotechnology companies can sustain the pipeline of new drugs under the Inflation Reduction Act

New research from the Center for Integration of Science and Industry at Bentley University shows that differences between the financial structures of large pharmaceutical producers and smaller, emerging biotechnology companies creates synergies that contribute to the pipeline of new, innovative products in response to reductions in drug prices anticipated under the Inflation Reduction Act (IRA). While large pharmaceutical producers would likely reduce R&D spending in response to lower product revenues, R&D in smaller biotechnology companies is not likely to decrease and could sustain both corporate profits and new product approvals at current levels. This analysis suggests claims that the IRA would reduce the number of new drugs for unmet medical needs are likely false.

A paper released today titled “Modeling impact of Inflation Reduction Act price negotiations on new drug pipeline considering differential contributions of large and small biopharmaceutical companies,” published in the journal Clinical Trials, showed that for large pharmaceutical producers, which account for the large majority of product sales, revenue, and profit, the level of R&D spending was strongly related to revenue from 2000-2018. In contrast, for smaller biotechnology companies, which typically have few products and little revenue but sponsor the majority of all clinical trials, there was no relationship between R&D spending and revenue. These companies typically acquire capital for R&D substantially through new investment in equity offerings.

This research also assessed the impact of reducing drug pricing on the number of new drug approvals using a drug development pipeline model that considers the differential contributions of large and small companies and likely changes in R&D spending in response to changes in revenue. This analysis suggests the current level of drug approvals could be maintained in the face of global revenue reductions of up to 10% through strategic distribution of cost reductions in large companies between early and late phases of clinical development, coupled with continued acquisition of candidate products in early phases of development by biotechnology companies.

A related working paper titled “Implications of the Inflation Reduction Act for the biotechnology industry; sensitivity of investment and valuation to drug price indices and market conditions,” published by the Institute for New Economic Thinking, showed that there was no relationship between investment in biotechnology and indices of drug prices 2000-2020. This suggests that investment in biotechnology companies is unlikely to be affected by decreases in drug prices and will continue to provide the capital necessary for early-stage innovation and development in biotechnology companies.

These studies describe a dynamic innovation process in which small, emerging biotechnology companies originate the majority of new products and sponsor the majority of all clinical trials with innovation capital arising from private or public investment. These products may then be developed by the biotechnology companies themselves or acquired by large pharmaceutical companies for late-stage development and commercialization. The analysis suggests that the industry can sustain current levels of product approval and commercialization without compromising corporate earnings or investor returns.

These studies do not support industry arguments that drug price reductions anticipated by the IRA represent a threat to corporate profits, investor returns, or new product approvals.

“Pharmaceutical innovation is not adequately described by conventional economic theories that fail to account for the distinct business models of small, science-based biotechnology companies” said Fred Ledley, Director of the Center for Integration of Science and Industry, and the senior author on these studies. “Our work suggests that established management and investment practices could preserve both the industry’s profits and current levels of drug approvals in face of the reductions in drug price anticipated by the Inflation Reduction Act.”

Dr. Gregory Vaughan, Associate Professor of Mathematical Sciences at Bentley University, was the lead author of the publication in Clinical Trials along with Roger Du and Dr. Ledley. Dr. Cody Hyman, Assistant Professor of Accounting at Bentley University, was the lead author of the working paper published by INET along with Henry Dao, Dr. Vaughan, and Dr. Ledley. Roger Du and Henry Dao worked as undergraduate researchers at Bentley University.

This work was funded by the West Health Policy Center and National Biomedical Research Foundation through grants to Bentley University.